How to Get Your 1099-G online. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124.

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

You can choose to receive your 1099-G electronically through MiWAM or by US.

Can i get my 1099 g unemployment online. You can also use the Check Claim Status tool to get your Form 1099-G. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. To access your Form 1099-G online log into your account at unemploymentstatemius.

UC dashboard PUA dashboard. Can I get my unemployment w2 online. Click the Get Your NYS 1099-G button on.

If you do not have an online account with NYSDOL you may call. How do I get my 1099 from unemployment. However you can also view this form from.

Statements for Recipients of New Jersey Income Tax Refunds Form 1099-G Form 1099-G for New Jersey Income Tax refunds is only accessible online. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. IMPORTANT INFORMATION FOR TAX YEAR 2021.

Receive Form 1099G You can access your Form 1099G information in your UI OnlineSM account. If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2021 you may be the victim of identity theft. If you dont have eServices account and want to hear the amounts on your 1099-G you can get this info from our automated claims line.

For tax year 2021. You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document. Instructions for the form can be found on the IRS website.

Recipients need to get the electronic version from their states website. Can You Get Unemployment If You Are Fired. Youll receive your 1099-G via mail.

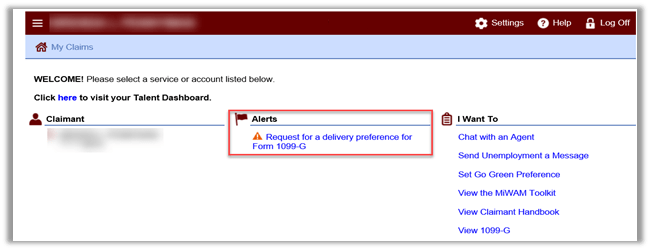

Click the Unemployment Services button on the My Online Services page. Sign in to your eServices account and click on the 1099 tab. Under I Want To select View 1099-G If you did not select electronic as your delivery preference by January 9 th 2021 you will automatically be mailed a paper copy of your Form 1099-G.

1099-G tax forms are not available online at this time. The statements called 1099-G or Certain Government Payments are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year. To reprint your 1099-G look under the I Want To heading in MiWAM and click on the blue 1099-G link.

Please check back soon. You can bring your 1099-G and proof of the repayments to a qualified tax preparer who would be the best source for answers to any questions you have about reporting your unemployment payments. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

This is the fastest option to get your form. We do not mail these forms. To access this form please follow these instructions.

1-888-209-8124 This is an automated phone line. Payment history in UI Online or by calling 1-866-333-4606 If you dont agree with the amount on your Form 1099G call 1-866-401-2849 and provide your current address and phone number To learn how to get detailed unemployment payment information in UI Online refer to UI Online. If you prefer to have your Form 1099-G mailed you may request a copy from your Reemployment Call Center.

To access your Form 1099-G log into your account at labornygovsignin. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. After 1099-G forms for 2021 are available online select Get your 1099-G from My UI Home in the online claimant portal to access your 1099-G tax forms.

You will receive your Form 1099-G by email. The 1099-G form for calendar year 2021 will be available in your online account at labornygovsignin to download and print by mid-January 2022. Forms will be mailed to all claimants by the January 31 st deadline.

Where to find your 1099-G info. The 1099-G tax form is commonly used to report unemployment compensation. To access prior year forms select My UI Summary then select 1099-G Tax Information in the online claimant portal.

The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence. I need a copy of my 1099-G where do I get that. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

UC 1099-G and PUA 1099-G forms must be mailed by January 31 st of each year. If you received unemployment compensation you should receive Form 1099-G showing the amount you were paid and any federal income tax you elected to have withheld. You can receive a copy of your 1099-G Form multiple ways.

This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am.

How To Get Your 1099 Form. It may take 10 business days to receive a copy of your Form 1099-G. To view and print your statement login below.

To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. Can I get my 1099-G form online. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Click the Unemployment Services button on the My Online Services page. Then click on the 1099-G letter for the involved tax year. To access your Form 1099-G log into your account at labornygovsignin.

Access Tax InformationForm 1099G Using UI Online YouTube. Some states do not mail Form 1099-G. If you have an eServices account youll be able to see it there as well.

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

The Ultimate Guide To Self Employed Tax Deductions Quickbooks Tax Deductions Tax Deductions List Deduction

Labor And Economic Opportunity How To Request Your 1099 G

Helping The Unemployed File Their Taxes Understand The 1099g Form Whas11 Com

Apparel Busin Business Design Lash Marketing Small Apparel Design Small B Small Business Accounting Small Business Bookkeeping Small Business Finance

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 G Tax Form Why It S Important

Labor And Economic Opportunity How To Request Your 1099 G

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

What To Do If You Can T Get Access To Your 1099g Tax Form Abc7 Southwest Florida

1099 G Tax Information Ri Department Of Labor Training

Self Employed Tax Preparation Printables Instant Download Small Business Expense Tracking Accounting In 2021 Tax Prep Checklist Tax Preparation Small Business Tax

0 Response to "Can I Get My 1099 G Unemployment Online"

Post a Comment