Auxiliary aids and services are available upon request to assist individuals with disabilities. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731.

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

TRENTON Approximately 80000 New Jersey workers receiving extended unemployment Insurance UI are due to exhaust these state benefits in coming weeks as they reach the 13-week maximum.

Nj ui benefit. PLEASE READ THIS TO AVOID DELAY IN PAYMENT. Frequently Asked Questions During the Coronavirus Emergency. Each claim is reviewed on a case-by-case basis and your eligibility for benefits is subject to New Jersey Unemployment Compensation Law.

Regular Base Year Earnings New Jersey unemployment claims are dated for the Sunday of the week in which the claim is filed. I am getting squat for replies. I try for all types of work remote some in person ranging from entry level to mid career level paying from 14 to 25 an hour.

Per federal regulations on April 17 2021 NJ state extended unemployment. The New Jersey Department of Labor has assigned a team of agents to review claims approaching end-of-benefit-year status to preemptively determine whether the claimant must file a new claim or. In addition you must also have logged sufficient income during.

The maximum weekly amount is recalculated annually and is equal to 56 23 percent of the statewide average weekly wage. The New Jersey Department of Labor and Workforce Development announced that fiscal year 2022 July 1 2021 to June 30 2022 state unemployment insurance SUI tax rates range from 05 to 58 on Rate Schedule C up from a range of 04 to 54 on Rate Schedule B for fiscal year 2021 July 1 2020 to June 30 2021. The NJ Department of Labor and Workforce Development NJ DOL via the Division of Unemployment Insurance DUI manages the states unemployment insurance programNew Jerseys unemployment remains higher than the United States as a whole which is reflective of how hard the state has been hit by the pandemic compared to other parts of the nation.

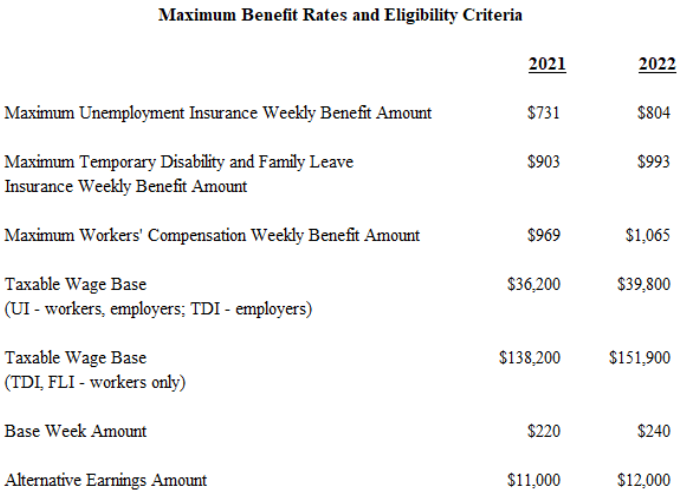

In New Jersey you can qualify for benefits if you have experienced job loss or significant reduction in your income or hours through no fault of your own. A claimant can collect a maximum of 26 weeks of benefits on a regular unemployment claim. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731 the New Jersey Department of Labor Workforce Development NJDOL said.

For more information read our guides about. Claimants who exhaust extended benefits will have received up to 88 weeks of unemployment a maximum of 26 weeks of regular state. Qualify for unemployment benefits.

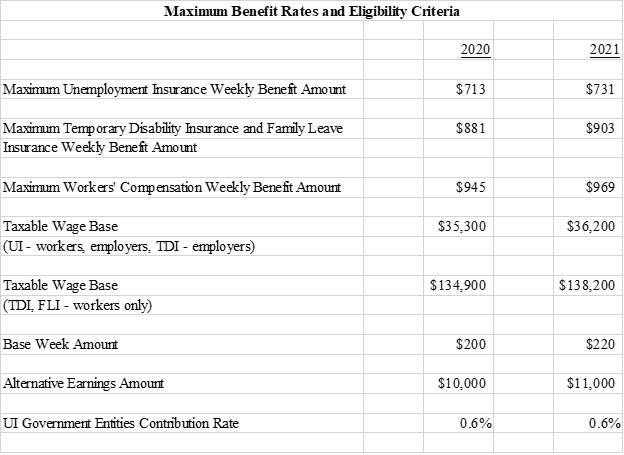

This number is then multiplied by the number of weeks that you worked during the base period up to a maximum of 26 weeks. 12000 up from 11000 Base week amount. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731.

The maximum weekly benefit for new state plan Temporary Disability and Family Leave Insurance claims increases to 993 from 903 while the maximum weekly benefit for new Workers Compensation claims rises to 1065 from 969. Box 946 Trenton NJ 08625-0946. 2 2022 and later.

Amount and Duration of Unemployment Benefits in New Jersey. The new employer rate remains at 28 for FY 2022. 804 up from 731 Maximum TDI weekly benefit rate.

Known as The Great Resignation a whopping 19 million employees quit their jobs just between March 2021 and July 2021. UIHCWD - Unemployment Insurance deductions that have been withheld from your paychecks with an annual maximum of 15003 TDI - Temporary Disability Insurance deductions that have been withheld from your paychecks with an annual maximum of 35074. The increased rates will be effective for new claims dated Jan.

The New Jersey Department of Labor and Workforce Development is an equal employment opportunity employer and provides equal opportunity programs. December 9 2021. Prior to this legislation claimants could only receive 26 weeks of benefits regardless of what the claimants maximum benefit entitlement was under UI.

You will be prompted to answer the questions below to certify for benefits. The maximum anyone can receive regardless of how many weeks they worked during the base year or how much they earned is 26 times the maximum weekly benefit rate. Benefit Payment Control 1 John Fitch Way 4 th floor PO.

Her maximum benefit amount will be 300 x 26 7800. The maximum weekly benefit for new state plan Temporary Disability and Family Leave Insurance claims increases to 993 from 903 while the maximum weekly benefit for new Workers Compensation claims rises to 1065 from 969. Whats the maximum amount of unemployment you can get in NJ.

Please make sure you understand the questions before submitting your answers. The Unemployment compensation UC program is designed to provide benefits to most individuals out of work or in between jobs through no fault of their own. Benefit Payment Control 609 292-0133 609 943-5180.

If you need health insurance you or your family may be eligible for free or low-cost coverage from NJ FamilyCare. Right now the maximum total benefit amount any one claimant can receive during their annual claim period is 20904 804 x 26. Maximum unemployment insurance UI weekly benefits rate.

Note the table below contains the the maximum regular. The Shared Work program allows employers to keep employees and avoid layoffs by allowing staff members to receive partial Unemployment Insurance benefits UI while working reduced hours. Fraud Hotline 609 777-4304.

Listed in the table below are the latest maximum weekly unemployment insurance benefitcompensation amounts by state. If you are eligible to receive unemployment your weekly benefit rate WBR will be 60 of your average weekly earnings during the base period up to a maximum of 713. 993 up from 903 Alternative earnings test amount for UI and TDI.

Additionally on July 1 2020 New Jerseys high unemployment rate triggered extended benefits for NJ workers who have exhausted unemployment benefits if they meet among other requirements the minimum earnings requirement and the date of their initial UI claim is May 12 2019 or later. BPC-98 Response Line 609 292-0011. Failure to accurately answer these questions may delay your payment and require the help of an agent.

Guide To New Jersey Unemployment Insurance Benefits

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

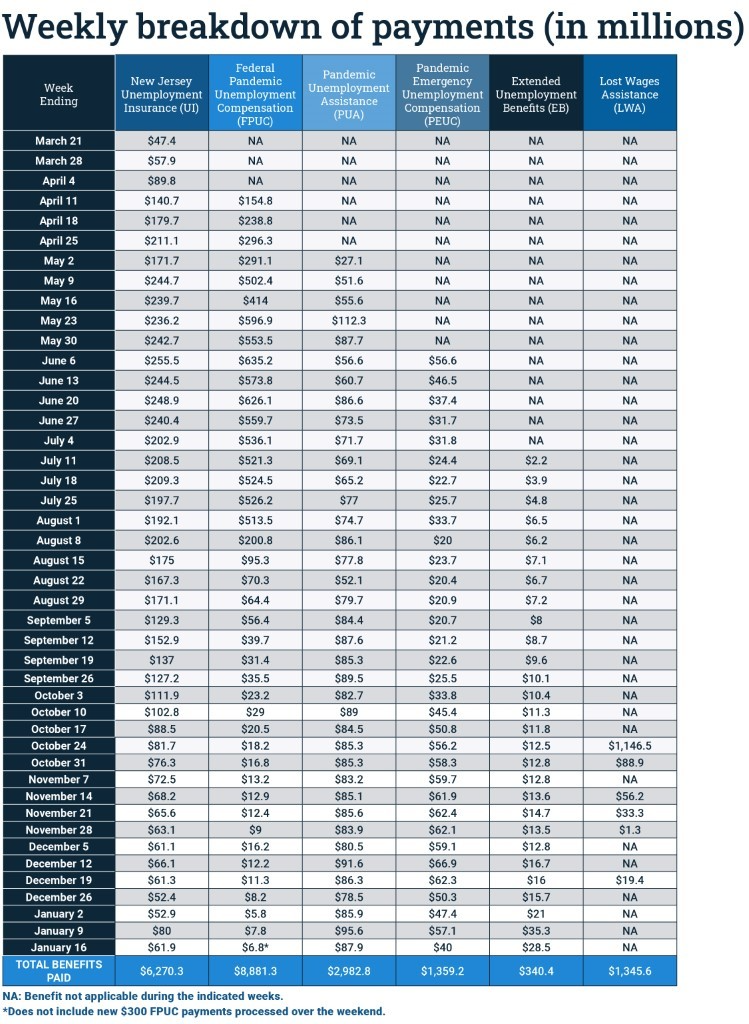

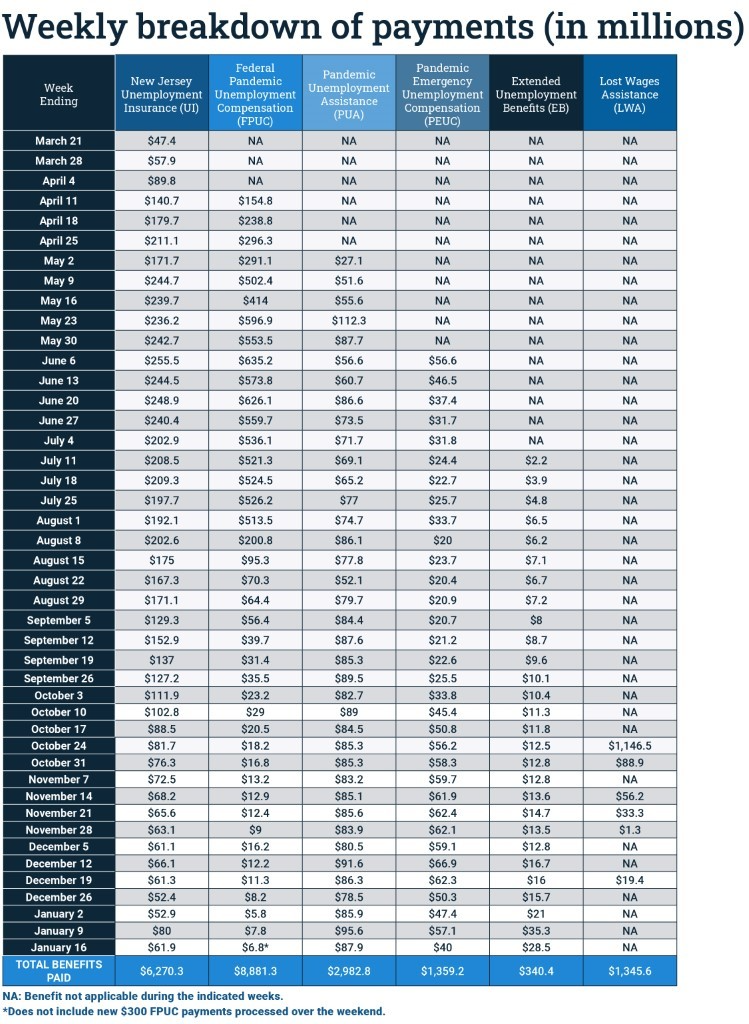

Total Pandemic Relief To Nj Workers Nears 35b As Federal Benefits Expire New Jersey Business Magazine

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

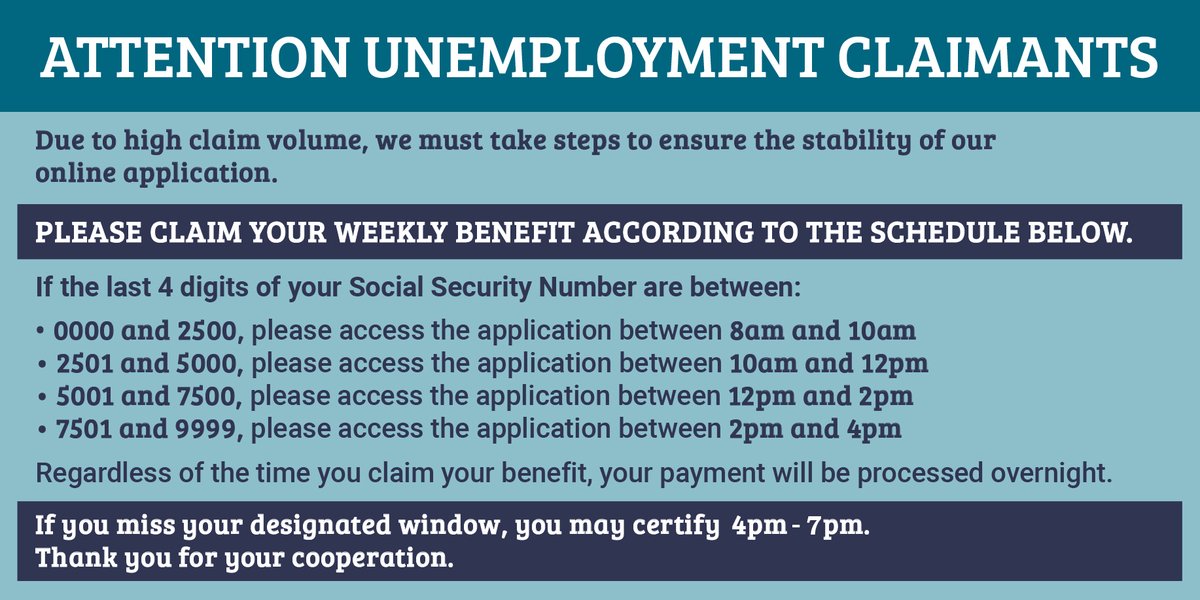

Nj Unemployment Server Is Down Backlog Of Claims Continue To Grow Parsippany Focus

A Guide To The Extended Unemployment Benefits In New Jersey

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Lsnjlaw An Overview Of The Unemployment Appeals Process

Njdol Commissioner Njdolcommish Twitter

Division Of Unemployment Insurance How To Certify For Benefits Online

Njdol Jobless Residents Receive New Stimulus Payments

New Jersey Unemployment Benefits Eligibility Claims

0 Response to "Nj Ui Benefit"

Post a Comment