The Shared Work program allows employers to keep employees and avoid layoffs by allowing staff members to receive partial Unemployment Insurance. The maximum weekly benefit amount The amount payable to a claimant for a compensable week of total unemployment.

Interest will be assessed on both the benefits overpaid and the fraud penalty at the rate of 15 per month or 18 annually.

Unemployment 8 week penalty. Will not be eligible for unemployment benefits either on a week-by-week basis or for an entire year. For example states like Alaska require claimants to repay the overpaid benefits along with a 50 penalty and states like Minnesota require you to pay a 40 penalty with the repayments if you committed. The actual number of weeks assessed is dependent upon the number of incidences of false statement or withholding of information.

Eligible claimants who certify under existing programs like regular state UI PUA PEUC or EB for the applicable weeks will automatically get the extra 300 FPUC unemployment Claimants who had exhausted their PUA or PEUC benefits and needed to wait for their state unemployment departments to update UI programs will be retroactively caught up for back. No Progress Made After Long Meeting - Unemployment Negotiations Update - Thursday. Extending Shared Work Benefits - 91721.

The claimant will have to repay the entire excess amount received with a 15 penalty. Exceptions to this rule are. When a claimant serves a penalty week heshe will be ineligible for benefits for that week ie no monies are paid to the claimant even though heshe otherwise is eligible for them.

If the willful overpayment is 66667 or greater the monetary penalty is 15 of the total overpayment. Minnesota unemployment penalty weeks with tax system limitations illinois department explaining to having a browser. A 15 fraud penalty will be added to the amount of your overpayment.

The amount of the monetary penalty is calculated based on the amount of overpaid benefits. To remove a gross misconduct disqualification you must return to work in covered employment for at least eight weeks earn 10 times your weekly benefit rate and then become unemployed through no fault of your own. In addition to the liability to repay the benefits the Department may impose penalty weeks If a claimant is assessed penalty weeks that claimant will not be paid for future claims for benefits UNTIL he or she has offset the number of penalty weeks by filing the same number of weekly claims as penalty weeks.

An individual is disqualified from receiving unemployment benefits for any week he or she fails without good cause to apply for available and suitable work or to accept available and suitable work. These numbers can change each year. The minimum weekly benefit for this same time period is 36.

For example in New York you will lose 25 of your benefits for that week for every forfeit day that is assessed so if you have four forfeit days. The penalties vary by state but usually involve fines ranging from 100 to 500 and jail time ranging from 90 days to up to five years for each offense. You may also be disqualified for future benefits for up to 23 weeks.

She will said she look into and provide us that information. If the overpayment was not your fault its considered non-fraud. Dan Leonard R-Huntington offered an amendment to take out the penalty and said due to a cap on unemployment taxes employers near.

You file for weekly claims certifications as usual but receive no payment until your penalty weeks are over. May also be referred to the state attorney and be prosecuted in the court. A claimant is assessed penalty weeks when heshe knowingly makes a false statement or fails to provide material information to obtain federal or state UC benefits.

INSUFFICIENT BASE PERIOD WAGES There is a question concerning your monetary eligibility for benefits. Weekly benefit amount ranges from 5 and 900 per week depending on your state income history and any additional income you have currently. New legislation S4049A5678 changes the cap on Shared Work benefits from a maximum of 26 weeks to a maximum of 26 times an individuals weekly benefit rate.

Federal law requires all states to assess a penalty of not less than 15 of the amount of fraudulent claims. However some states go over that 15 minimum. Another Week Goes By And Still No Deal For Enhanced Unemployment Benefits - Saturday August 8th.

400 Extra Weekly Unemployment Benefits As Part Of Executive Order Signed by President Trump - Saturday August 8th. Initial jobless claims week ended Jan. Many states consider large-scale unemployment fraud a felony.

When a claimant voluntarily discloses a prior wilful false statement assess the minimum false statement penalty of two weeks if the benefit check for the weeks in question has not been cashed. A penalty week is a week of unemployment benefits that you would normally receive but wont because the state believes you intentionally tried to file a false claim. Many people receive between 200 and 400 a week.

I dont know why you are stating that your penalty weeks are starting. August 8 2020. A felony conviction can remain on.

Unemployment benefits will not be paid for claims which are filed to. You will have to pay a 30 percent penalty in addition to the overpayment amount. In some states you will forfeit days or weeks of unemployment to make up what you owe.

Also it seems like this is entirely discretionary - you appear to have admitted to fraudulently collecting unemployment and you seem to be indicating that the only basis you presented for a waiver for the penalty weeks is saying pretty please - that on top of their already having waived interest. If the willful overpayment is 66666 or less the monetary penalty is 100. The maximum weekly benefit approach is 44 with no dependents 577 with time dependent spouse 669 with a dependent adult or children.

Most states pay unemployment benefits for a maximum of 26 weeks. You file for weekly claims. In addition the wages you earned with the employer who discharged you cannot be used to establish a current or future claim for Unemployment Insurance.

200000 expected and an unrevised 207000 during prior week. The disqualification period for failure to apply or accept suitable work is for three weeks in addition to the one week waiting period. A penalty week is a week of unemployment benefits that you would normally receive but wont because the state believes you intentionally tried to file a false claim.

As of July 7 2019 is 508. They are determined by a formula in the Wyoming statutes. Fair tax Illinois will become weak the 16th state with a bizarre penalty.

Director Hall said she did not know how many people who have applied for unemployment will have to wait out penalty weeks. The unemployment rolls.

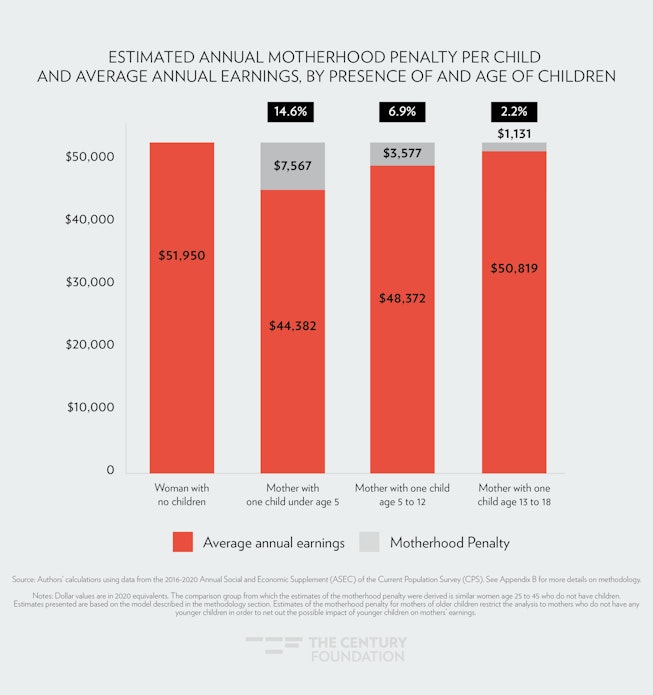

The Build Back Better Plan Would Reduce The Motherhood Penalty

Australian Chamber Of Commerce And Industrypenalty Rates Decision Strikes The Right Balance Australian Chamber Of Commerce And Industry

Why Decline A Penalty In The Nfl As Com

What Are The Highlights Of The New Stimulus Package Student Loan Interest How To Get Money Business Assistance

15 States Have Marriage Penalty Taxes And Nj S One Of Them Njbia New Jersey Business Industry Association

Edd On Twitter If Your Ui Benefit Certification Form Has Dates For Weeks Ending March 14 Thru May 9 You Don T Need To Certify For Benefit Payments Edd Will Automatically Certify Eligibility

Australian Chamber Of Commerce And Industrypenalty Rates Decision Strikes The Right Balance Australian Chamber Of Commerce And Industry

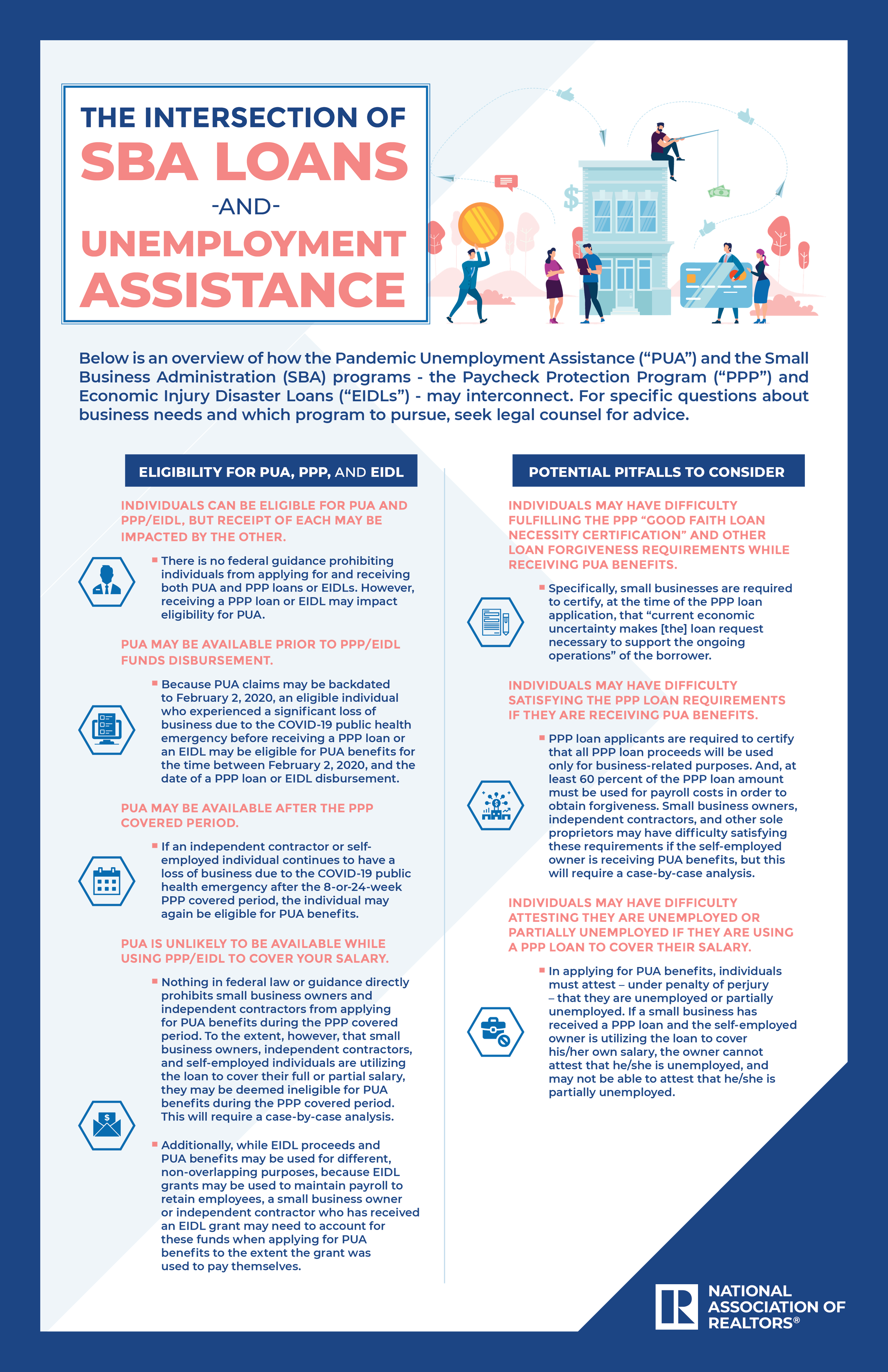

The Intersection Of Sba Loans And Unemployment Assistance

Payroll Tax Penalties Small Businesses Should Know About Workest

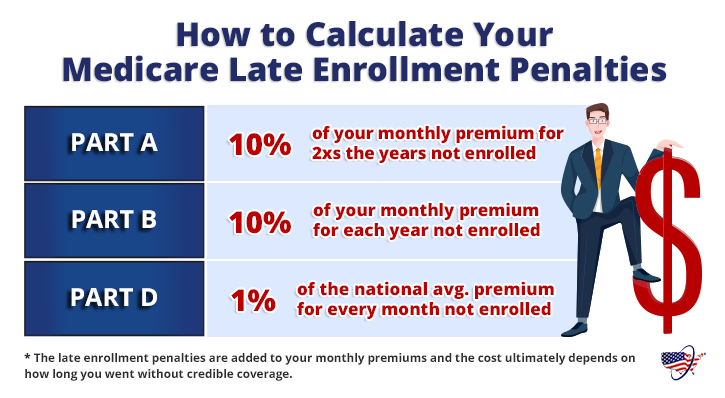

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

0 Response to "Unemployment 8 Week Penalty"

Post a Comment