New Jerseys job market is still missing 146700 positions that existed in February 2020 before Governor Phil Murphys lockdown began. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731.

Meghan Markle Attends An Anzac Day Service Of Commemoration And Meghan Markle Hair Meghan Markle Prince Harry And Megan

2022 Maximum Workers Compensation weekly benefit rate.

Nj unemployment maximum 2022. New Jersey defends its handling of unemployment matters. 2021 to 2022 State Extended Unemployment Benefits Maximum Weeks and Coverage After PEUC and PUA Programs Expired in September. For 2022 the maximum weekly benefit rate is 804.

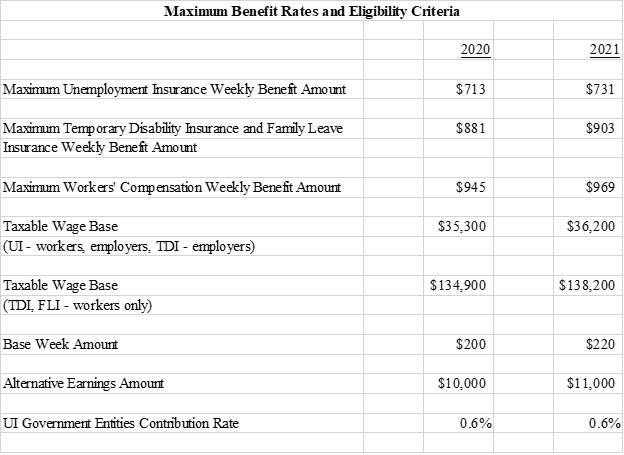

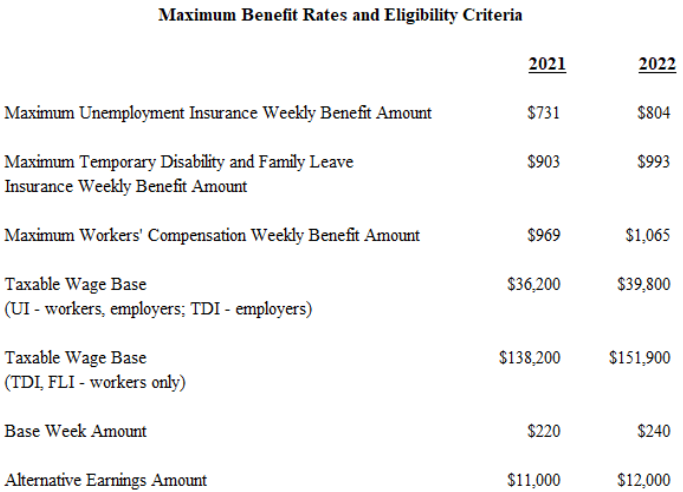

For calendar year 2022 the maximum unemployment insurance temporary disability insurance and workers compensation benefit rates the alternative earnings and base week amounts and the taxable wage base are listed below. 2 2022 and later. The reserve factor used in part to calculate an experienced employers unemployment tax rate will not be released until later.

The catch-up contribution limit remains at 6500 for individuals who. Income Up Despite High Unemployment By Kyle Sullender Executive Director Focus NJ On Jan 3 2022. Unemployment insurance is taxable income and must be reported on your IRS federal income tax return.

Maximum unemployment insurance UI weekly benefits rate. In 2018 the maximum weekly benefit amount is 68100. Once released other 2022 SUI information will be posted here.

Update for PEUC claimants Regardless of when claims started and how many weeks of PEUC claimed up to the 75 week maximum ALL enhanced benefit programs ended on September 6th 2021. What are the maximum benefits payable on an unemployment claim. Yet thanks to an unprecedented influx of government assistance during the pandemic total personal income in the state is up 34.

This form is sent in late. The maximum weekly amount is recalculated annually and is equal to 56 23 percent of the statewide average weekly wage. New Jersey DOL Contact Info.

The increased rates will be effective for new claims dated Jan. New Jerseys unemployment rate is now the second highest in the nation at 7 compared to the national rate of 46 according to federal data released Friday. Employees unemployment and workforce development wage base increase to 36200 maximum.

Thats according to newly-released September 2021 data from the US. We will calculate your weekly benefit rate at 60 of the average weekly wage you earned during the base year up to that maximum. Listed below are the 2022 maximum benefit amounts taxable wages and earning requirements for New Jersey Un employment Compensation State Temporary Disability Family Leave and Workers Compensation Programs.

In roughly 22 months the Labor Department has paid 36 billion to about 15 million claimants said spokeswoman Angela Delli-Santi. Under the proposed rules 53 NJR. The maximum employee pretax contribution increases to 20500 in 2022.

A claimant may potentially receive 60 percent of hisher average weekly wage not to exceed the maximum weekly amount. Yet the pace at which New Jersey is recovering is better when compared to previous recessions economists say. This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021.

And while 81 of jobs have been recovered nationwide the Garden State lags at 71. New Jerseys unemployment rate 71 is now Americas 3rd highest. New Jersey has the third highest unemployment rate in the nation according to the Bureau of Labor Statistics October data release.

Your local state unemployment agency will send you form 1099-G to file with your tax return see due dates. We determine the average weekly wage based on wage information your employers report. Whats the maximum amount of unemployment you can get in NJ.

Although the state relied on archaic systems and complex outdated benefit requirements the technology performed remarkably well she said. New Mexico Workforce Connection Contact Info. 2022 Rates Unemployment Compensation.

The same maximum applies to employers covered under Temporary Disability Insurance the Workforce Development Partnership Program or Supplemental Workforce Fund for Basic Skills. 1465 a the 2022 unemployment-taxable wage base is to be 39800 for employers and employees up from 36200 in 2021. Under the proposed regulations other SUI and TDI amounts for calendar year 2022 will be as follows.

This wage base also is applicable for employer contributions to the temporary disability insurance program. The taxable wage base increases from 27000 to 28700 in 2022. 804 up from 731.

New York DOL 1888581-5812. The increased rates will be effective for new claims dated January 2 2022 and later. The 2022 taxable wage base and other 2022 SUI rates and limits have not yet been announced.

2022 Maximum Unemployment Insurance weekly benefits rate. New Jersey is tied for the fifth-highest unemployment rate in the nation behind Nevada New York New Mexico and California. Since the start of the pandemic New Jersey has distributed 337 billion worth of jobless benefits 25 billion of which came from new federal programs.

New Jersey Unemployment Tax. The level of wages subject to unemployment taxes in 2022 increased to 39800 for both workers and employers. A claimant can collect a maximum of 26 weeks of benefits on a regular unemployment claim.

North Carolina DES 1888737-0259. The unemployment tax rates for new employers vary by industry and range from 10 to 131 in 2022 10 to 123 in 2021. Other SUI and TDI amounts for calendar year 2022.

Maximum Weekly Benefit Amount 804. The employer taxable wage base will continue at 36200 for the remainder of calendar year 2021. For employers for 2021 the wage base increases to 36200 for unemployment insurance disability insurance and workforce development.

The wage base is computed separately for employers and employees. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731 the New Jersey Department of Labor Workforce Development NJDOL said. The increased rates will be effective for new claims dated January 2 2022 and later.

New Jersey Department of Labor Workforce Development website SUI taxable wage base. Bureau of Labor Statistics for all 50 states.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

Nj Temporary Disability Insurance Rates For 2022 Shelterpoint

Nj Temporary Disability Insurance Rates For 2022 Shelterpoint

Top Unemployment Benefits To Jump 10 In 2022 To 804 A Week Roi Nj

Unemployment Benefits Extension 2022 Will Your State Send You Checks In 2022 Marca

Unemployment Benefits Comparison By State Fileunemployment Org

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

What To Know About Unemployment Benefits In The New Relief Package

Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022 Insider Nj

Nj Unemployment Benefit Rates Increase In Nj Started On January 1st

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

0 Response to "Nj Unemployment Maximum 2022"

Post a Comment