Ohio State Disability Insurance SDI Industrial Commission 30 W. HB 413 freezes the 2021 SUI taxable wage base to 10800 rather than the increase to 11100 that was originally published.

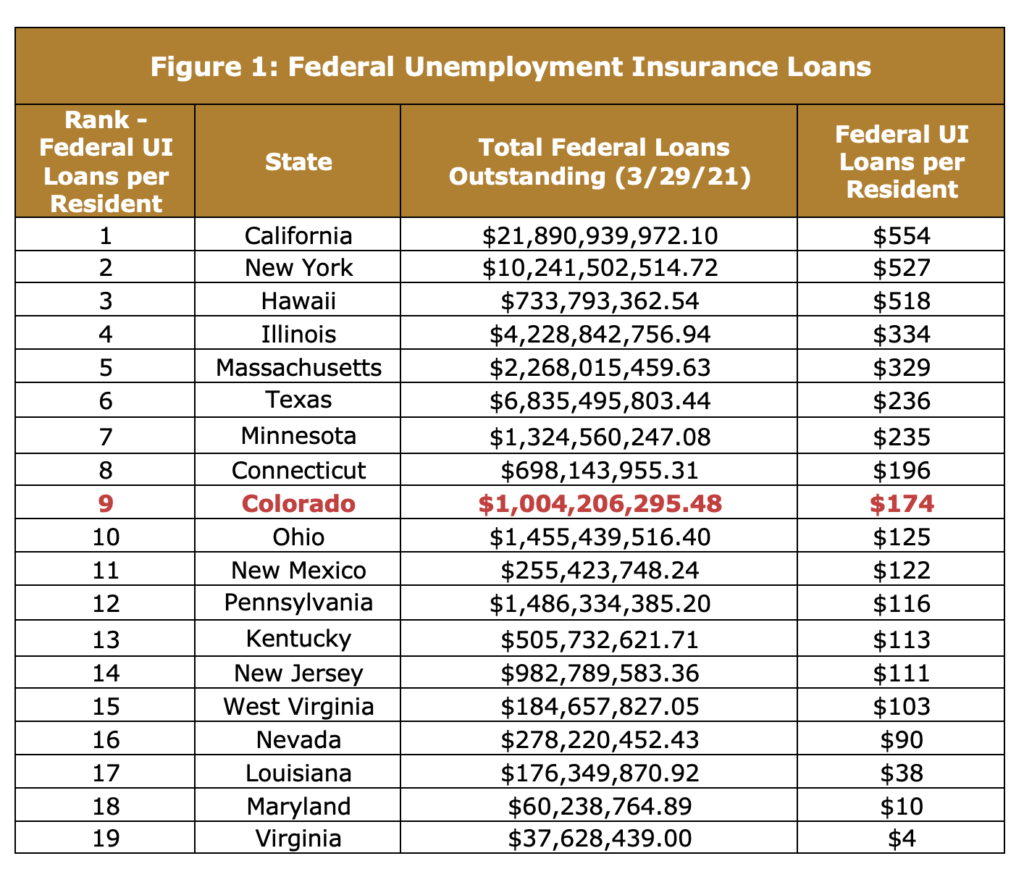

The State Of Colorado S Unemployment Insurance Trust Fund Common Sense Institute

According to a Department representative the taxable wage base will increase to 10000 for 2021.

Ohio unemployment wage base 2021. 03 Highest Experience Rate. Additional information such as most recent quarterly earnings proof of wages earned in the form of pay stubs and verification of earned wages may be asked for in case of the Alternate Base Period. Ohios unemployment tax rates are to generally are to increase for 2022 the Department of Job and Family Services said Dec.

Mixed Earner Unemployment Compensation. 1 2021 the mutualized tax rate is to be 05 and is to be added to experienced employers unemployment tax rates the department said on its website. Ohio 9000 9000 9500 9500 Oklahoma 24000 18700 18100 17600 State Unemployment Insurance Taxable Wage Bases 2018-2021 Updated as of 11-13-20.

State Wage Base Alabama 8000 Alaska 43600 Arizona 7000 Arkansas 10000 California 7000 Colorado 13600 Connecticut 15000 Delaware 16500 District of Columbia 9000 Florida 7000 Georgia 9500 Hawaii 47400 Idaho 43000 Illinois 12960 Indiana 9500 Iowa 32400. The states use various formulas for determining the taxable wage base with a few tying theirs by law to the FUTA wage base. Ohio SUI Rates range from.

Ohio State Unemployment Insurance SUI Ohio Wage Base. The taxable wage base will continue to increase as follows. 1 2021 unemployment tax rates for positive-rated employers are to range from zero to 108 compared with zero to 117 in 2020 the department said on its website.

27 except construction Construction Industry. The taxable wage base is 9000 for 2021. The federal Consolidated Appropriations Act of 2021 created the Mixed Earner Unemployment Compensation MEUC program for eligible traditional unemployment claimants who also earned at least 5000 in self-employment wages during the taxable year immediately before their approved unemployment application.

The average weekly wage is determined by dividing your total wages earned during the base period from any employer who pays unemployment contributions by the total number of weeks worked during the same base period for the same employers. States who havent released their SUI wage base limits for 2021 are bolded in black. Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year.

In addition during times when the UI trust fund balance falls below a specified level the SUI wage base could increase to 11000 or 12000. The Alternative Base Period for unemployment benefits is the last four completed calendar quarters preceding the starting date of the claim. The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases that exceed the required amount.

State Unemployment Taxable Wage Base. The FUTA tax rate protection for 2021 is 6 as per the IRS standards. Ohio unemployment tax rates are to increase for 2021 because a mutualized tax is to be in effect the state Department of Job and Family Services said Nov.

FUTA Tax Rates and Taxable Wage Base Limit for 2021. Ohio new employer rate. The Taxable Wage Base is the amount of an employees wages on which the employer is required to pay unemployment taxes each year.

State 2021 WAGE BASE 2020 WAGE BASE 2019 WAGE BASE 2018 WAGE BASE Oregon 42100 40600 39300 Pennsylvania 10000 10000 10000 10000. The taxable wage base may change from year to year. Kentucky Office of Unemployment Insurance electronic workplace for employment services KEWES website The unemployment tax relief provided under HB 413 also extends to 2022.

Unemployment-taxable wage bases are not to be changed Effective Jan. Unemployment tax rates are to range from 08 to 102. The taxable wage base for calendar year 2020 and subsequent years is 9000.

Average weekly wage of at least 298 before taxes or other deductions. Depending on the UI benefit rate the SUI wage base could range from 7000 to 10000. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year.

2022 STATE WAGE BASES Updated 092921 2021 STATE WAGE BASES 2020 STATE WAGE BASES 2019 STATE WAGE BASES. Prepared by the editors of PayState Update. 05 New Employer Rate.

2022 Lowest Experience Rate. Employers should be aware that due to UI trust fund balances that are lower than anticipated and economic concerns regarding employer taxes some states may change their taxable wage bases later this year or early next year. For each year thereafter computed as 16 of the states average annual wage.

Many states have released their state unemployment insurance taxable wage bases for 2021. Ohio new construction employer rate. The taxable wage base for calendar year 2020 and subsequent years is 9000.

08 to 128 for 2021. Once an employees year to date gross earning. If an individual works for two or more employers both employers are required to pay unemployment taxes on the first 9000 each employer pays to that individual.

Ohio 9000 9000 9500 9500 Oklahoma 24000 18700 18100 17600 Oregon 43800 42100 40600 39300 State Unemployment Insurance Taxable Wage Bases 2018-2021 Updated as of 2-1-21. 2021 SUI wage base retroactively lowered. 128 Annual Taxable Wage Base.

The mutualized tax which is not. Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year. 2016 legislation SB 235 increased the SUI taxable wage base to 9500 for calendar years.

Prepared by the editors of PayState Update. The unemployment-taxable wage base is to be 9000. The first 7000 for each employee will be the taxable wage base limit for FUTA.

Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year.

![]()

Unemployment Tax Wage Base Ballotpedia

Suta State Unemployment Taxable Wage Bases Aps Payroll

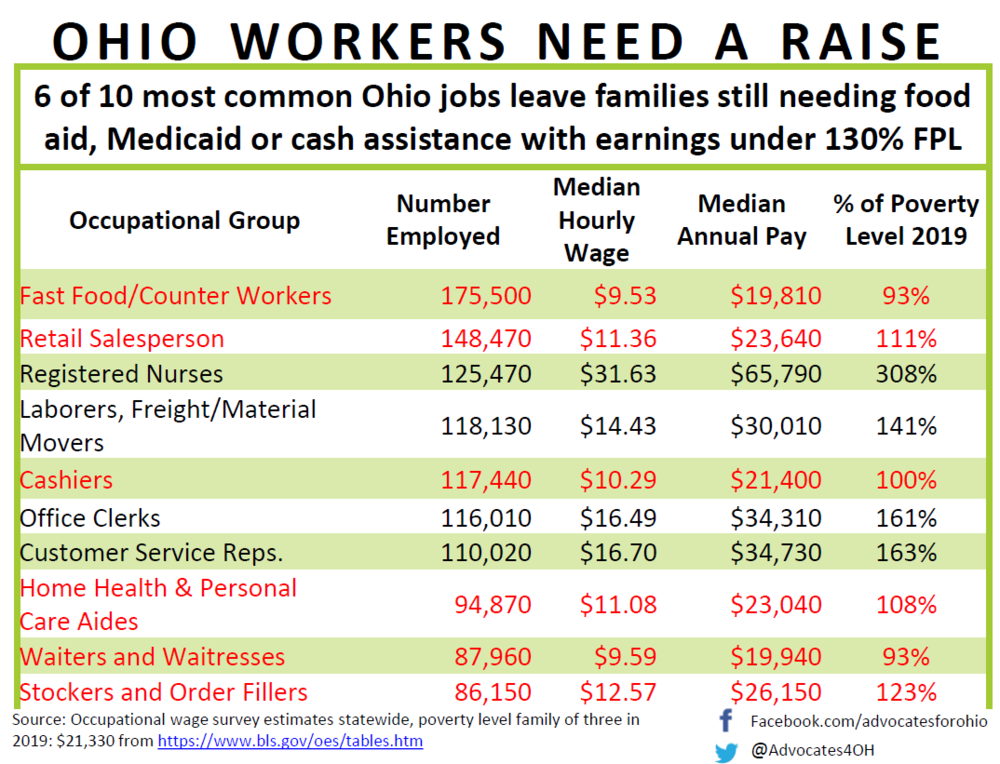

2021 Federal Poverty Level Scorecard Advocates For Ohio S Future

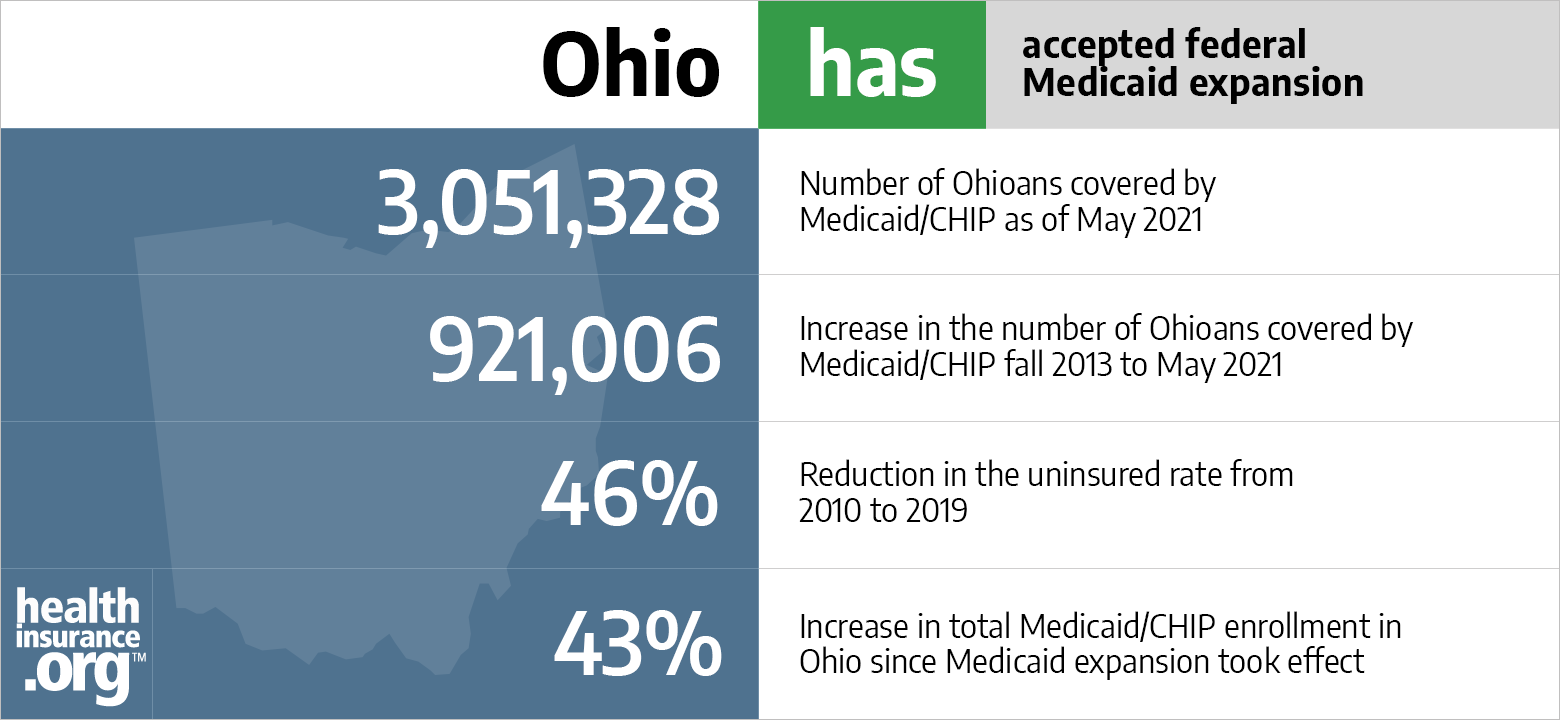

Aca Medicaid Expansion In Ohio Updated 2022 Guide Healthinsurance Org

How To Apply For Ohio Unemployment Benefits Credit Karma

Unemployment Benefits Comparison By State Fileunemployment Org

Odjfs Report Usps R Documentation Ssdt Confluence Wiki

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Unemployment Tax Wage Base Ballotpedia

Ohio Employers It S Time To Update The Ohio 2021 Minimum Wage Posting Has Released Compliance Poster Company

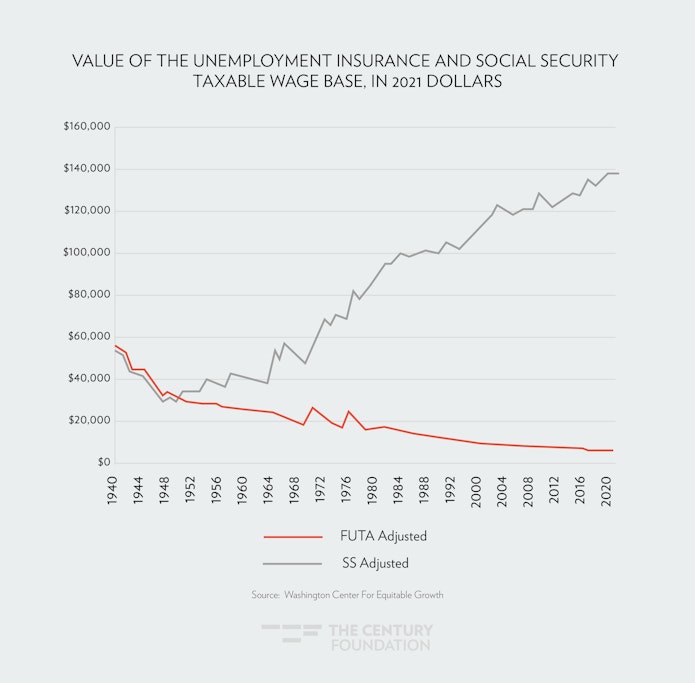

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

Base Period Calculator Determine Your Base Period For Ui Benefits

2021 Federal Poverty Level Scorecard Advocates For Ohio S Future

0 Response to "Ohio Unemployment Wage Base 2021"

Post a Comment