In determining your Gross Non-Excluded Income WorkWORLD asks you about and subtracts most of the following types of income. Ask Your Own Employment Law Question.

Social Protection Statistics Unemployment Benefits Statistics Explained

No Section 8 Housing Choice Voucher tenants do not need to report the income they get from the government stimulus check to their housing authority.

Can section 8 count unemployment as income. There is no requirement for the Section 8 voucher payments to have been received for any period of time prior to the date of the mortgage application or for the payments to continue for any period of time from the date of the. Section 8 vouchers are given to tenants who meet income limits in the area where they apply for the voucher. This includes household stimulus payments and Pandemic Unemployment Compensation.

In doing so HUD removed 24 CFR part 813 and set forth the definition of annual income at 24 CFR 56092 CPD never changed its definition in part 570 to conform to the change so 24 CFR 5703 cites the outdated 24 CFR 813106. Maximum Income for Section 8 Section 8 is designed to help low-income households with rent rates they can afford. The Section 8 program is run by HUD.

It is counted as income by Section 8 by the direction of HUD. 1 Income from employment of children including foster children under the age of 18 years. Income from employment of children including foster children under the age of 18 years.

HUD HOPWA Does Not Count 400 Extra Unemployment Benefit as Income Nov 02 2020 HUDs Office of Community Planning and Development CPD announced that the Housing Opportunities for Persons with AIDS HOPWA program will exclude from income calculations the 400 per week or in some states 300 per week extra unemployment benefit allowed under. Included is guidance pertaining to payments under the CARES Act. To even be considered to receive a voucher the individual must meet four basic criteria which include their family status income level citizenship and eviction history.

Attachment A Section 8 Definition of Annual Income 24 CFR Part 5 Subpart F Section 5609 5609 Annual Income. Because the stimulus assistance is technically an advance tax credit and because the up to 600 per week federal unemployment insurance payments issued under the CARES Act are temporary they are not to be included in calculations of income. 2 Payments received for the care of foster children or foster adults usually persons.

Does unemployment affect Section 8. To avoid Fair Housing complaints you want your leasing process to stay as consistent and equal as possible. Applying for or receiving Section 8 assistance INCOME EXLCUSIONS.

To a student who is living with hisher parents who are applying for or receiving Section 8 assistance INCOME EXCLUSIONS. 1 Go to or on behalf of the family head or spouse even if temporarily absent. And site-based section 8 to say that the additional 600week FPUC is not counted as income for purposes of calculating rent.

Specifically you asked 1 if governmental energy assistance funds would be counted as income when utilities are included in the rent and 2 what a voucher recipient must list as income. CDBG grantees should not include as income two forms of unemployment assistance. 2 Payments received for the care of foster children or foster adults usually persons with disabilities unrelated to the tenant family who are unable to live alone.

Temporary or non-recurring unemployment benefit payments such as the 600 per week. Yes regular unemployment benefits are considered income for HUD subsidized housing including housing assistance provided by the Section 8 Housing Choice Voucher Public Housing and Project-based Section 8 programs. Federal Pandemic Unemployment Compensation FPUC which provided individuals who were collecting regular unemployment compensation UI to receive an additional 600 in federal benefits per week for weeks of unemployment that ended on or before July 31 2020.

Foster Care Payments. On Thursday April 16 2020 HUD posted an updated Questions and Answers for Office of Multifamily Housing Stakeholders. Determining Income Calculating Rent 5-13 states.

Section 8 doesnt limit your assets but they do count any income those assets generate when determining your eligibility. The Housing Choice Voucher Program more commonly known as Section 8 is also an acceptable source of qualifying income. A Annual income means all amounts monetary or not which.

Meeting the limits doesnt automatically mean you will receive a voucher since many housing authorities have long wait lists for Section 8 vouchers. HUD Provides Guidance for Pandemic Unemployment Compensation. Once you have a voucher you can use it anywhere in the country.

However HUD notes that regular payments of unemployment insurance issued by the state are treated as income as. HUD counts regular unemployment income in this way and has extended that to PUA payments as well. For some applicants this can be a few months of bank statements or paystubs for others it can be unemployment documentation.

If an agency is reducing a familys benefits to adjust for a prior overpayment eg social security SSI TANF or unemployment benefits count the amount that is actually provided after the adjustment. The purpose of this program is to grant housing choice vouchers to individuals who meet certain criteria. The HUD Occupancy Handbook 43503 Change 4 Chapter 5.

Department of Housing and Urban Development HUD issued guidance both for Public Housing Agencies PHAs including their administration of voucher programs. Income Exclusions for Section 8. Section 8 housing and other assisted housing programs and created a new subpart F to 24 CFR part 5.

1 Income from employment of children including foster children under the age of 18 years. No the temporary federal enhancement to unemployment 600 weekly provided by the CARES Act is not included as annual income for Section 8 Housing Choice Voucher and Public Housing tenants. However regular unemployment payments issued by the state that are not part of the CARES Act stimulus package are counted as income and should be reported to.

Just like with any applicant your leasing process likely requests proof of income. Customer reply replied 12. Payments received for the care of foster.

Under the Housing Choice Voucher code of federal regulations these types of payments are not considered as part of a participants annual income. SUMMARY Federal regulations establish what counts and is excluded as income when local public housing authorities PHAs determine a person s eligibility for the Section 8 housing.

Cutoff Of Jobless Benefits Is Found To Get Few Back To Work The New York Times

Social Protection Statistics Unemployment Benefits Statistics Explained

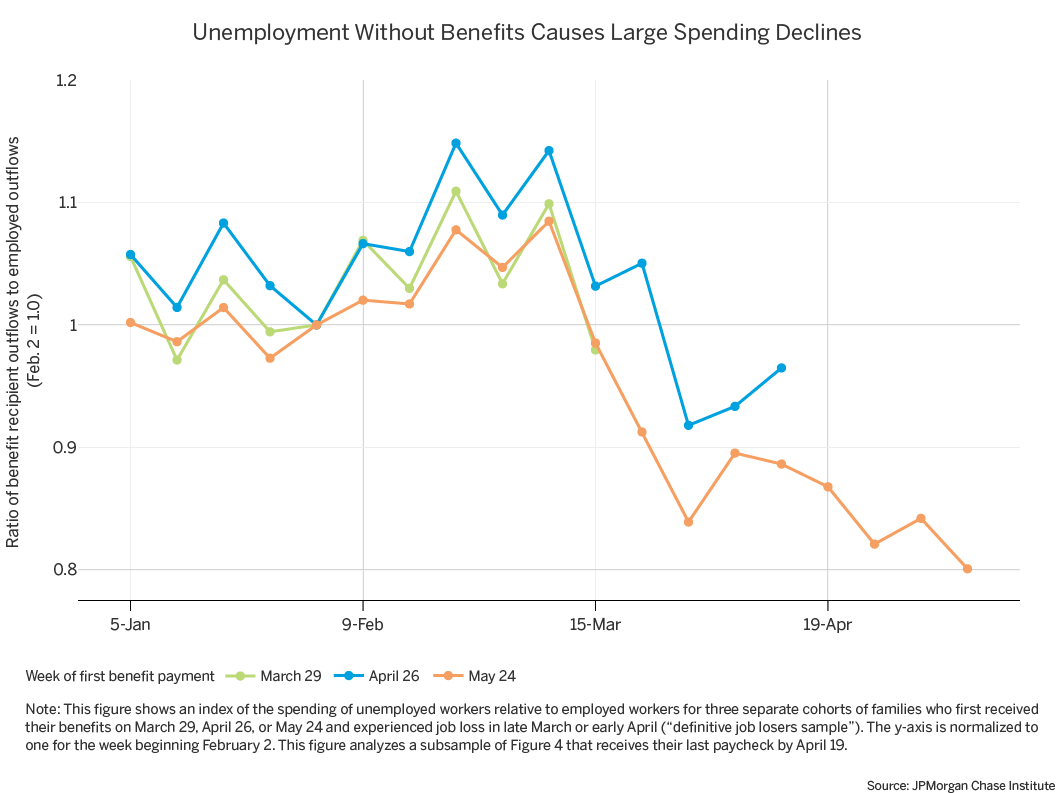

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

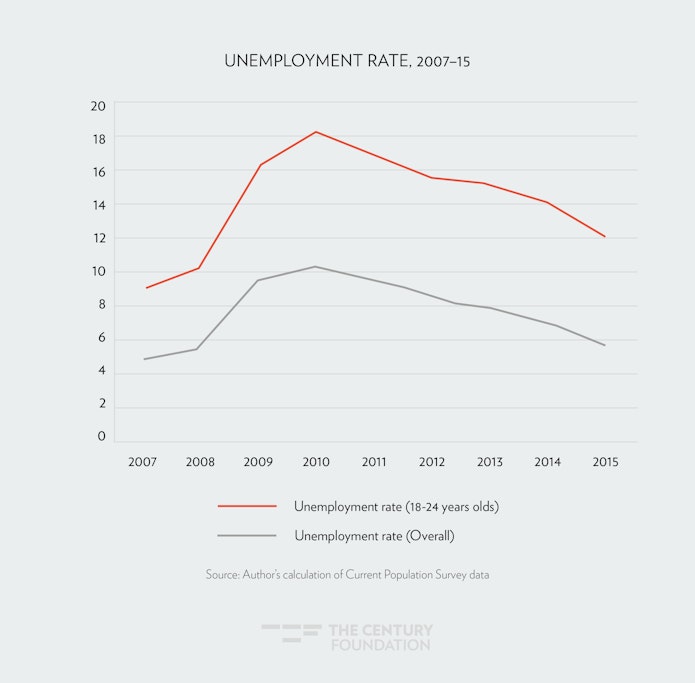

Unemployment Insurance And Young People In The Wake Of Covid 19

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

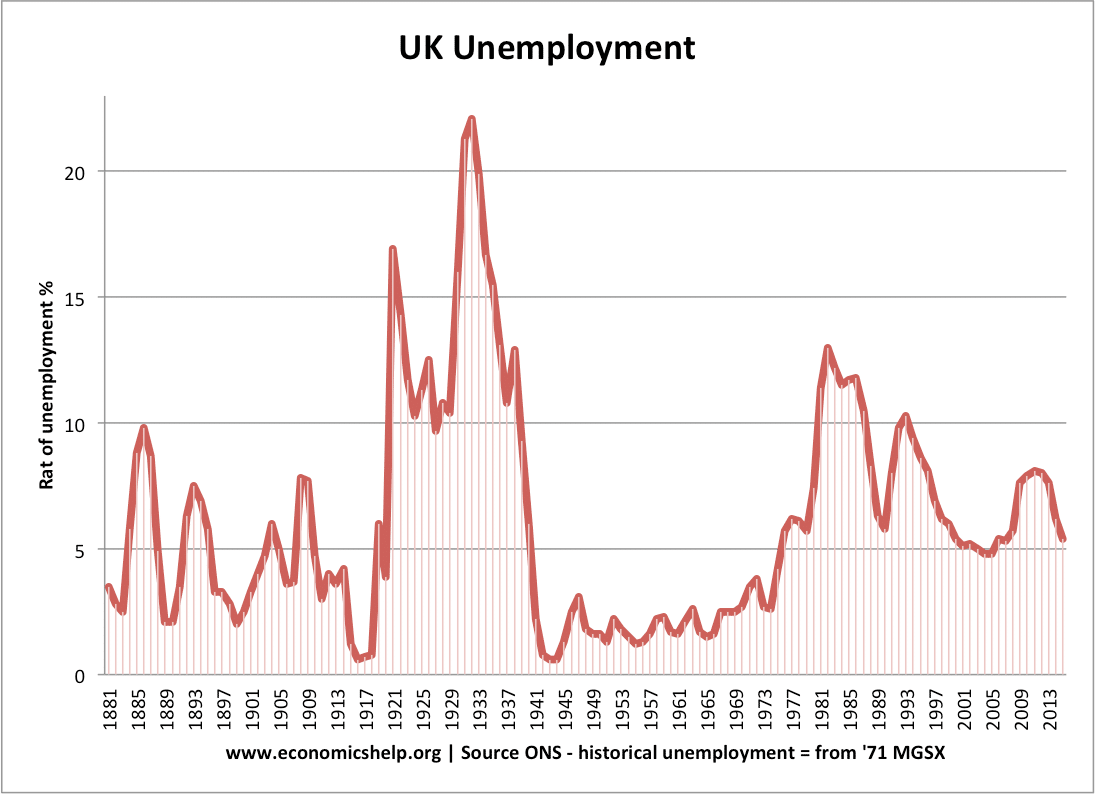

Voluntary Unemployment Economics Help

Social Protection Statistics Unemployment Benefits Statistics Explained

Social Protection Statistics Unemployment Benefits Statistics Explained

Social Protection Statistics Unemployment Benefits Statistics Explained

Potential Impact Of Covid 19 Related Unemployment On Increased Cardiovascular Disease In A High Income Country Modeling Health Loss Cost And Equity

Excessive Pandemic Unemployment Benefits Are A Warning Against Unemployment Program Expansions The Heritage Foundation

Social Protection Statistics Unemployment Benefits Statistics Explained

Food Stamps And Unemployment Compensation In The Covid 19 Crisis Research Highlights Upjohn Institute

0 Response to "Can Section 8 Count Unemployment As Income"

Post a Comment